Sometimes, when it comes to investing, volatile markets aren’t your worse enemy. You are. Unfortunately, our brains often play tricks on us, causing even the savviest of investors to make decisions that don’t really make a lot of sense, such as panic selling or ignoring opportunities.

The problem of psychological investing traps is so pervasive, in fact, that there’s a whole field dedicated to studying it called behavioral finance. Researchers in this discipline look at the way psychology affects how we make financial decisions. Knowing about these traps can help you avoid them and make you a better investor. Here are seven psychological traps to keep in

mind.

Sunk Costs Bias — The sunk costs bias has to do with the all-too common tendency to stick with

something, whether a bad boyfriend or a bad investment, long after it’s clear that it’s not worth it anymore. Still, because you’ve invested a certain

amount of time or money, you’re reluctant to give it up. In investing, you might end up hanging on to a stock long after you should sell it in the vain hope that you’ll eventually come out ahead. But in

these cases, it’s better to cut your losses rather than to hang on to a loser.

Familiarity Bias — Most of us are biased toward what is familiar to us. We head to restaurants we’ve been to before and follow the same roads to work because we know what to expect. With investing, familiarity bias involves favoring investments that are familiar to you. You might prefer to invest in the company you work for or big-name businesses that are in the news. That

could cause you to overlook important opportunities you don’t know as much about.

Anchoring — Anchoring is the process of getting attached to a particular reference point – such as the price you paid for a stock — and using that to guide future decisions. Or you might fixate on a stock’s previous high, even though that price was an anomaly. Anchoring is why buyers think they got a great deal when buying a car for $50,000 when the initial price was $60,000, even though the car’s really worth $40,000.

Whether buying stocks or cars, anchoring involves using a single piece of information to determine what a stock or other investment

should be worth while also discounting more relevant information, such as a company’s fundamentals or broader economic trends. Unfortunately, avoiding anchoring is difficult,

but considering all available information before choosing an investment can help.

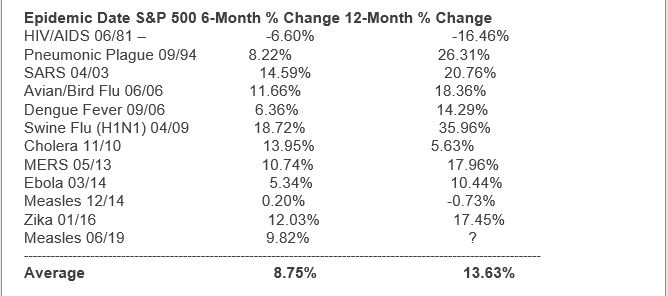

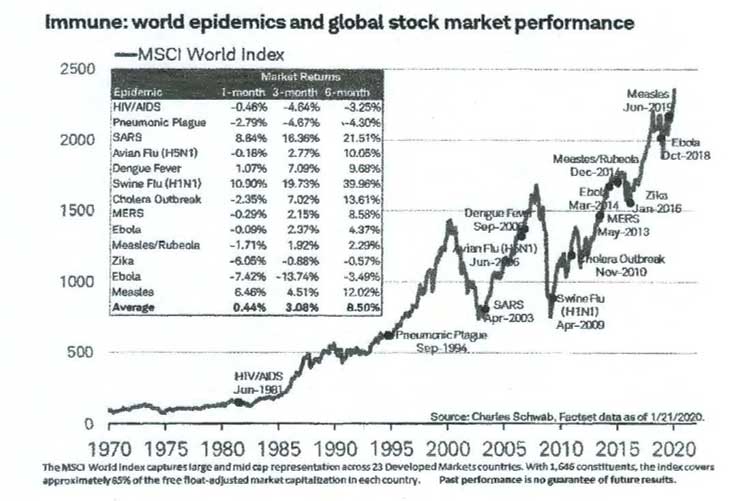

Focusing Too Much on the Recent Past — Recency bias is the tendency to make decisions or judgments based on relatively new or recent information. For example, during times when the market is up, people may ignore or discount the

possibility of a market decline. Or, if a certain category of stocks has done poorly recently, people may conclude that those stocks always have negative returns, even if the dip is an anomaly. You can avoid this mistake by doing your best to consider the entire universe of information at your fingertips, not just what happened yesterday.

Following the Herd – While following trends might be fine for fashionistas, it’s not always a smart investing move. Yet herd investing

is an all-too-easy trap to fall into. If everyone is telling you that now’s the time to get into a certain hot investment, you may feel you need to act fast so you don’t miss out. But just because something is popular doesn’t make it a good investment. Blindly following the herd without first consulting your own financial goals and plan doesn’t make you a smart investor.

Overconfidence — Most of us like to think we’re smarter than the average person. If you hit it big

with a certain investment, you may over-attribute that success to your skill rather than what it really is — luck. That can cause you to repeat

the same behavior again.

Panic — Investing isn’t for the faint of heart. When the market takes a sudden dip, it’s easy to

panic, which can lead you to make bad decisions, such as selling at a big loss, rather than riding out the natural hills and valleys of investing.

Making these emotionally driven choices costs you a lot of money. When making investing decisions, make sure they’re based on evidence, not your initial gut reaction to the day’s events.

Avoiding psychological investing traps on your own can be difficult.