Archive for ROTH

To make sure you’re on track for retirement, you should have an idea of how much you need to set aside to reach your retirement goal.

Know Your Limits — Before you come up with an annual savings target, it’s important to understand how much you’re allowed to contribute to a 401(k) plan. In 2021, workers younger than 50 can save $19,500 in a 401(k), 403(b), or similar plan, while those age 50 and older can save $26,000 annually, an extra $6,500 per year.

Contribution limits usually go up slightly every year; if you’re an aggressive saver, you’ll also want to pay attention to that and adjust accordingly.

At a Minimum, Get Your Match — The first rule of 401(k) plans is to save enough to get your full employer match. You’ve probably heard it before, but not contributing enough to get your employer’s matching contributions

is like leaving free money on the table. Even if you’re not impressed with your company’s 401(k) plan and would prefer to save in some other way, it still makes sense to at least get that free money.

But How Much Do I Really Need? — So you know how much the government will let you save and that you should be contributing enough to get your employer match. But how much should you be setting aside to prepare yourself for a comfortable retirement? That’s the ultimate question.

Unfortunately, there’s no magic number because every individual situation is different. People have different tolerances for risk, market performance varies over time, and everyone has their own idea of an ideal retirement. That’s why it’s best to talk to a financial advisor who can help you determine how much you need. But in the meantime, there are a few rules of thumb that may help you get a sense of where you stand.

One guideline suggests saving a certain percentage of your salary every year for retirement. Between 10% and 15% is usually the recommended number. If you started saving when you were young, your target savings percentage is usually lower, but if you procrastinated, you’re more likely to be looking at having to save 15% or even 20% of your pay to get you on track to a comfortable retirement. The good news is that your employer match counts in that number, so if your goal is to save 10% and your employer match is 5%, you only need to save 5% of your pay.

As long as you have earned income and are not receiving RMDs, you can fund an IRA EVEN if you contribute to a company retirement plan.

You just need to use the right kind of account and perhaps file an additional IRS form when you make the contribution so the money can come out TAX-FREE in retirement. Sound good?

Then give me a call TODAY to learn how it can be done

— as tax filing day approaches rapidly!

You have until your tax return due date (not including extensions) to contribute up to $5,500 for 2017 ($6,500 if you were age 50 by December 31, 2017). For most taxpayers, the contribution deadline for 2017 is April 17, 2018.

There’s still time to make a regular IRA contribution for 2017! You have until your tax return due date (not including extensions) to contribute up to $5,500 for 2017 ($6,500 if you were age 50 by December 31, 2017). For most taxpayers, the contribution deadline for 2017 is April 17, 2018.

You can contribute to a traditional IRA, a Roth IRA, or both, as long as your total contributions don’t exceed the annual limit (or, if less, 100% of your earned income). You may also be able to contribute to an IRA for your spouse for 2017, even if your spouse didn’t have any 2017 income.

Traditional IRA

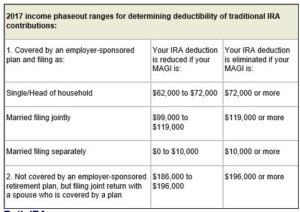

You can contribute to a traditional IRA for 2017 if you had taxable compensation and you were not age 70½ by December 31, 2017. However, if you or your spouse was covered by an employer-sponsored retirement plan in 2017, then your ability to deduct your contributions may be limited or eliminated depending on your filing status and your modified adjusted gross income (MAGI) (see table below). Even if you can’t deduct your traditional IRA contribution, you can always make nondeductible (after-tax) contributions to a traditional IRA, regardless of your income level. However, in most cases, if you’re eligible, you’ll be better off contributing to a Roth IRA instead of making nondeductible contributions to a traditional IRA.

Roth IRA

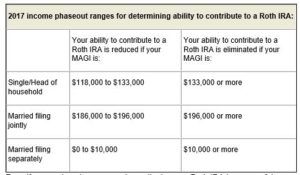

You can contribute to a Roth IRA if your MAGI is within certain dollar limits (even if you’re 70½ or older). For 2017, if you file your federal tax return as single or head of household, you can make a full Roth contribution if your income is $118,000 or less. Your maximum contribution is phased out if your income is between $118,000 and $133,000, and you can’t contribute at all if your income is $133,000 or more. Similarly, if you’re married and file a joint federal tax return, you can make a full Roth contribution if your income is $186,000 or less. Your contribution is phased out if your income is between $186,000 and $196,000, and you can’t contribute at all if your income is $196,000 or more. And if you’re married filing separately, your contribution phases out with any income over $0, and you can’t contribute at all if your income is $10,000 or more.

Even if you can’t make an annual contribution to a Roth IRA because of the income limits, there’s an easy workaround. If you haven’t yet reached age 70½, you can simply make a nondeductible contribution to a traditional IRA, and then immediately convert that traditional IRA to a Roth IRA. Keep in mind, however, that you’ll need to aggregate all traditional IRAs and SEP/SIMPLE IRAs you own — other than IRAs you’ve inherited — when you calculate the taxable portion of your conversion. (This is sometimes called a “back-door” Roth IRA.)

Finally, keep in mind that if you make a contribution to a Roth IRA for 2017 — no matter how small — by your tax return due date, and this is your first Roth IRA contribution, your five-year holding period for identifying qualified distributions from all your Roth IRAs (other than inherited accounts) will start on January 1, 2017.

Want more information or need clarification?

Then give me a call TODAY?

Let’s say you’re leaving one job and (hopefully) headed to another. Or you left retirement plan assets with a previous employer.

To Roll or Not to Roll (Over) Your Former Employer’s Retirement Plan?

Should you leave your retirement assets behind or move them to a new custodian? Did you know that both the custodian and your former employer can share in the fees?

What are the benefits of either course of action? If you do neither and simply ‘cash out’, what are the tax implications?

What are the benefits of either course of action? If you do neither and simply ‘cash out’, what are the tax implications?

If left behind there’s a chance the company may be acquired, merged or just go out of business. Then what? How will you access your money? How will you even find the company and get your money?

What if you move and they lose track of you due to returned mail or invalid email addresses? How will they (eventually) track you down? Or how will you find them? Isn’t there a central source for information like this?

Would you like to have more investment choices than may be available where the money is now or in your new employer’s plan? Would you prefer more diversity?

The Rollover IRA and Tax and Inheritance Considerations

Do you want to streamline passage of those assets to your heirs and beneficiaries by consolidating retirement accounts currently in more than one place?

Are you thinking of retiring before age 55 and perhaps tapping your retirement savings?

Does combining the inherent tax-deferral with living benefits such as guaranteed annual increases or guaranteed annual payouts when distributions start interest you? (Guarantees dependent on the claims-paying ability of the issuing carrier).

Do you want to decide which investments to draw from for your RMDs?

If you identify with even one of the questions above, you may benefit from a Rollover IRA.

Please contact Frank McKinley TODAY to discuss whether a Rollover IRA may be right for you.

If ‘buy low’ isn’t enough for you, here are five reasons to invest in the market now:

- What causes recessions isn’t happening now.

- U.S. exposure to China is minimal.

- U.S. companies are getting more efficient.

- Consumers are in good shape.

- Stocks are reasonably priced.

(Paraphrased from an article by Rick Newman, Yahoo Finance Feb. 9, 2016.)

Add in the power of compounding AND tax deferral to see why an early IRA contribution is so valuable! They can be made as early as Jan. 2 every year and as late as April 15 for the PRIOR year. But how about for the CURRENT year? They too can be made as early as Jan. 2 of the current year.

Why wait for the rush just before April 15 when money is pouring into the market often pushing share prices up? Why don’t you take advantage of a dip in the market and BUY LOW as you can today?

If you’re unsure of your eligibility to fund an IRA, PLEASE call me. Chances are you’re eligible, we just have to figure out what’s best: Traditional deductible or non; or ROTH. I can help with this but must know you want my guidance. So please, call or email me TODAY while the market is still on sale!

Call or email TODAY to arrange an appointment and discuss IRA and other investments in this Buyer’s Market!

Frank McKinley

Investment Professional

973-515-5184; Fax: 5190

www.FranklyFinancial.com

PLEASE UPDATE YOUR CONTACTS WITH THIS ADDRESS:

FranklyFinancial@NationwidePlanning.com

As I will only be receiving messages via the old one for a short time.

Representatives are registered through, and securities are sold through Nationwide Planning Associates, Inc., Member FINRA/SIPC, located at 115 West Century Road, Suite 360, Paramus, NJ 07652. Investment advisory services are offered through NPA Asset Management, LLC. Insurance sold through licensed NPA Insurance Agency, Inc. agents. Nationwide Planning Associates, Inc. and Frankly Financial are non-affiliated entities.

Archives

Categories

- 529 Savings Plans

- Blog

- Bonds

- College Savings

- Contributions

- Credit Card Debt

- estate planning

- financial planning

- Financial Services

- Insurance

- Investing

- Investments

- IRA

- Life Insurance

- Long-term Care

- Medicaid

- Medicare

- Newsletters

- Paycheck Protection Program

- rebate payments

- Retirement

- ROTH

- Savings

- Savings Goals

- Security

- Social Security

- socially responsible investing

- Stocks

- Tax

- The CARES Act

- the SECURE ACT

- unemployment benefits

- Wills

Site Designed by TriDelta Design Group