Archive for Stocks

Periodically, you should reassess your portfolio, finding ways to increase your comfort level with your stock investments. Consider the following

tips:

![]() Develop a stock investment philosophy. Approach investing with a formal plan so you can make informed decisions with confidence, knowing you have carefully considered your options before investing.

Develop a stock investment philosophy. Approach investing with a formal plan so you can make informed decisions with confidence, knowing you have carefully considered your options before investing.

![]() Remind yourself why you are investing in stocks. Write down your reasons for investing in each individual stock, indicating the long-term returns and short-term losses you expect. When market volatility makes you nervous, review your written reasons for investing as you did. That reminder should help keep you focused on the long term.

Remind yourself why you are investing in stocks. Write down your reasons for investing in each individual stock, indicating the long-term returns and short-term losses you expect. When market volatility makes you nervous, review your written reasons for investing as you did. That reminder should help keep you focused on the long term.

![]() Monitor your stock investments so you understand the fundamentals of those stocks. If you believe you have invested in a company with good long-term prospects, you are more likely to hold the stock during volatile periods.

Monitor your stock investments so you understand the fundamentals of those stocks. If you believe you have invested in a company with good long-term prospects, you are more likely to hold the stock during volatile periods.

![]() Review your current asset allocation. Revisit your asset allocation strategy, comparing your current allocation to your desired allocation. Now may be a good time to rebalance your portfolio, reallocating some of those stock investments to alternatives.

Review your current asset allocation. Revisit your asset allocation strategy, comparing your current allocation to your desired allocation. Now may be a good time to rebalance your portfolio, reallocating some of those stock investments to alternatives.

![]() Determine how risky your stocks are compared to the overall market. You can do this by reviewing betas for your individual stocks and calculating a beta for your entire stock portfolio. Beta, which can be found in a number of published services, is a statistical

Determine how risky your stocks are compared to the overall market. You can do this by reviewing betas for your individual stocks and calculating a beta for your entire stock portfolio. Beta, which can be found in a number of published services, is a statistical

measure of how stock market movements have historically impacted a stock’s price.

By comparing the movements of the Standard & Poor’s 500 (S&P 500) to the movements of a particular stock, a pattern develops that gauges the stock’s exposure to stock market risk.

Calculating a beta for your entire portfolio will give you a rough idea of how your stocks are likely to perform in a market decline or rally. If your stock is riskier than you realized, you can take steps to reduce that risk by reallocating.

![]() Keep the tax aspects of selling in mind. While you may be tempted to lock in some of your gains, you may have to pay taxes on them if the stocks aren’t held in tax-advantaged accounts. You’ll have to pay at least 15% capital gains taxes (0% if your income is under certain limits) on any stocks held over one year. If your gains are substantial, it may take longer to overcome the tax bill than to overcome a downturn in the market.

Keep the tax aspects of selling in mind. While you may be tempted to lock in some of your gains, you may have to pay taxes on them if the stocks aren’t held in tax-advantaged accounts. You’ll have to pay at least 15% capital gains taxes (0% if your income is under certain limits) on any stocks held over one year. If your gains are substantial, it may take longer to overcome the tax bill than to overcome a downturn in the market.

![]() Consider selling stocks if you have short-term cash needs. If you are counting on your stock investments for short-term cash needs, look for an appropriate

Consider selling stocks if you have short-term cash needs. If you are counting on your stock investments for short-term cash needs, look for an appropriate

time to sell some stock. With short-term needs, you may not have time to wait for your stocks to rebound from a market decline.

![]() Don’t time the market. During periods of market volatility, investors can get nervous and consider timing the market, which typically translates into exiting the market in fear of losses. Remember that most people, including professionals, have difficulty timing the market with any degree of accuracy. Significant market gains can occur in a matter of days, making it risky to be out of the market for any length of time.

Don’t time the market. During periods of market volatility, investors can get nervous and consider timing the market, which typically translates into exiting the market in fear of losses. Remember that most people, including professionals, have difficulty timing the market with any degree of accuracy. Significant market gains can occur in a matter of days, making it risky to be out of the market for any length of time.

![]() Remember you are investing for the long term. Even though short-term setbacks can give even the most experienced investors anxiety, remember that staying in the market for the long term, through different market cycles, can help manage the effects of market fluctuations.

Remember you are investing for the long term. Even though short-term setbacks can give even the most experienced investors anxiety, remember that staying in the market for the long term, through different market cycles, can help manage the effects of market fluctuations.

Please call if you’d like help implementing strategies that may make you more comfortable with your stock holdings.

Frankly Speaking

“Democracy is the process by which people choose the man who’ll get the blame.” -Bertrand Russell

“Everyone is a damn fool for at least five minutes a day; wisdom consists in not exceeding that limit.” -Elbert Hubbard

By now the election has hopefully been resolved, (like it or not). Democracy is attributed to Greece but didn’t really work, and we’ve spent 244 years proving them right. Or have we? The U.S. is a Democratic Republic, a democracy first and foremost, which is a government by the people; a republic second, having a division between the federal government and the states. If you didn’t vote you have no right or reason to complain. If you did but ‘your party’ didn’t get in, you have 4 years to help change things.

For an element of perspective, please call or email me. Remember, my job is to be here for you when things are bad!

If you would like more information or to discuss your financial concerns

The last time the yield on the 10-year Treasury note was above 1% was on 3/19/20 or 7 months ago today. The 10-year note yield closed at 0.74% last Friday 10/16/20 (source: Treasury Department).

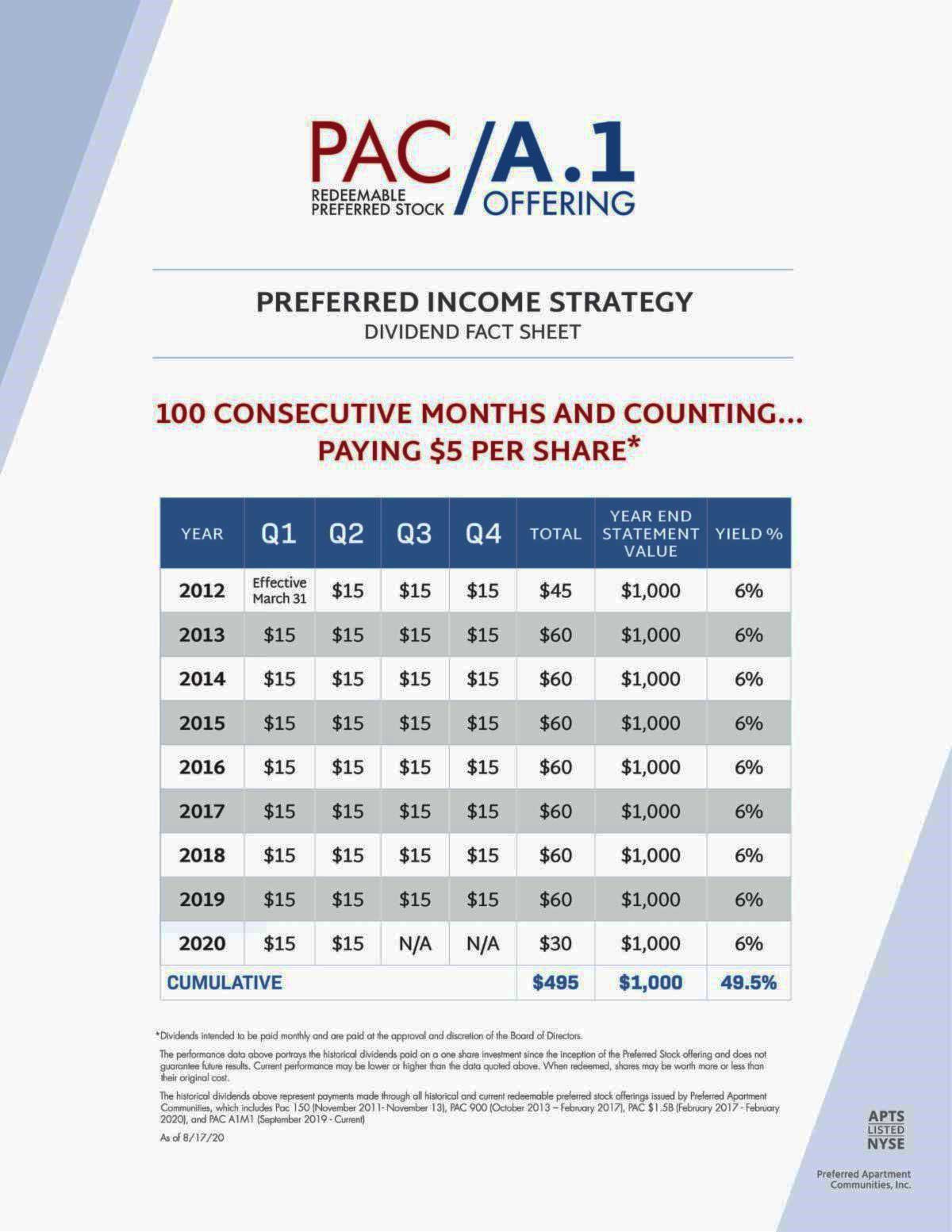

Preferred Apartment Communities has paid a consistent 6% dividend since inception, Q1, 2012. For more information on How To Invest, Please call Frank.

If you would like more information or to discuss your financial concerns

Archives

Categories

- 529 Savings Plans

- Blog

- Bonds

- College Savings

- Contributions

- Credit Card Debt

- estate planning

- financial planning

- Financial Services

- Insurance

- Investing

- Investments

- IRA

- Life Insurance

- Long-term Care

- Medicaid

- Medicare

- Newsletters

- Paycheck Protection Program

- rebate payments

- Retirement

- ROTH

- Savings

- Savings Goals

- Security

- Social Security

- socially responsible investing

- Stocks

- Tax

- The CARES Act

- the SECURE ACT

- unemployment benefits

- Wills

Site Designed by TriDelta Design Group