In a 2013 survey of people aged 50 to 70 with $100,000 or more in investable assets, 90% reported that they had experienced at least one setback in saving for retirement. In fact, the average respondent had experienced four setbacks with an average loss or missed opportunity of $117,000(1).

The future is always uncertain, and as the saying goes, “Life happens.” It would be wise to prepare for the unexpected and react logically rather than emotionally when faced with retirement challenges. Here are some obstacles you might need to overcome.

Surviving market downturns.

More than half of those surveyed said their assets had been reduced by market losses during the Great Recession.(2) Yet another survey suggested that about 50% of workers who were 32 to 51 when the recession started actually showed gains in their retirement accounts during the 2007 to 2009 period(3). This group may have had lower balances when the recession began, and it’s likely that they continued saving throughout the downturn, which might have helped them benefit when the market started to improve. Remember that all investments are subject to market fluctuation and the potential for loss.

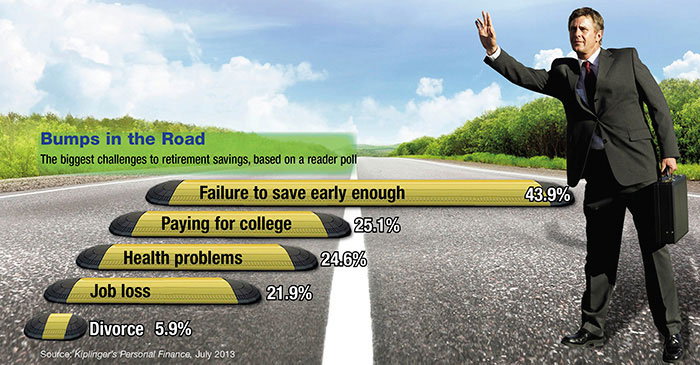

Saving too little or too late.

To accumulate sufficient assets to retire at age 65, one rule of thumb suggests saving 15% of income starting at age 25. Someone starting at age 35 might need to save about 30% each year, and the savings percentage would increase to about 64% annually for someone starting to save at age 45!4 If these percentages seem unrealistic, consider that any savings increase is better than none. In addition to maximizing your retirement contributions, you may also need to adjust your lifestyle and control your spending. Once you reach age 50, you are eligible to make additional “catch-up” contributions.

Experiencing a traumatic event.

A job loss, unexpected medical expense, death of a loved one, or divorce might make it difficult to save for retirement. Having an emergency savings account that could help cover at least three to six months of living expenses would put you in a stronger position. If possible, avoid tapping your retirement savings, especially tax-deferred IRAs and 401(k)s, because withdrawals are taxed as ordinary income and may be subject to a 10% federal income tax penalty if taken prior to age 59½. When your life returns to normal, try to save as much as possible at the highest contribution rate you can afford.

Balancing college and retirement.

When these two priorities compete, many people — 15%, according to one survey — stop saving for retirement to pay for their children’s educational costs.5 A wide variety of college funding options are available, but there is no “scholarship” for retirement. The key is to balance your children’s needs with your own retirement goals and find an appropriate strategy.

The road to retirement is long, winding, and seldom smooth. But with patience and a steady commitment, you could reach your destination regardless of how many obstacles you encounter along the way.

Call Frank for more information and assistance in planning your retirement.

1–2) DailyFinance.com, May 14, 2013

3) The Pew Charitable Trusts, 2013

4) Forbes.com, September 24, 2012

5) usnews.com, March 4, 2013

The information in this newsletter is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. © 2014 Emerald Connect, LLC.